Wealth Without a World: When Capital Outruns Civilization

What happens when our wealth systems no longer need a world to function — but we do?

We’re Winning on Paper. And Losing the Plot.

In 2024:

Global wealth hit $500 trillion for the first time.

AI-driven fund strategies generated a 27% alpha over traditional portfolios.

The top 1% controlled more wealth than the entire global middle class.

Meanwhile, in the same year:

42% of global topsoil became moderately to severely degraded.

The World Economic Forum ranked “Misinformation-Driven Societal Breakdown” as the #1 ten-year global risk.

Mental health disorders surpassed cardiovascular disease as the world’s leading health burden (WHO, 2024).

If you're managing capital today, ask yourself: Are your returns calibrated to a world that’s disappearing?

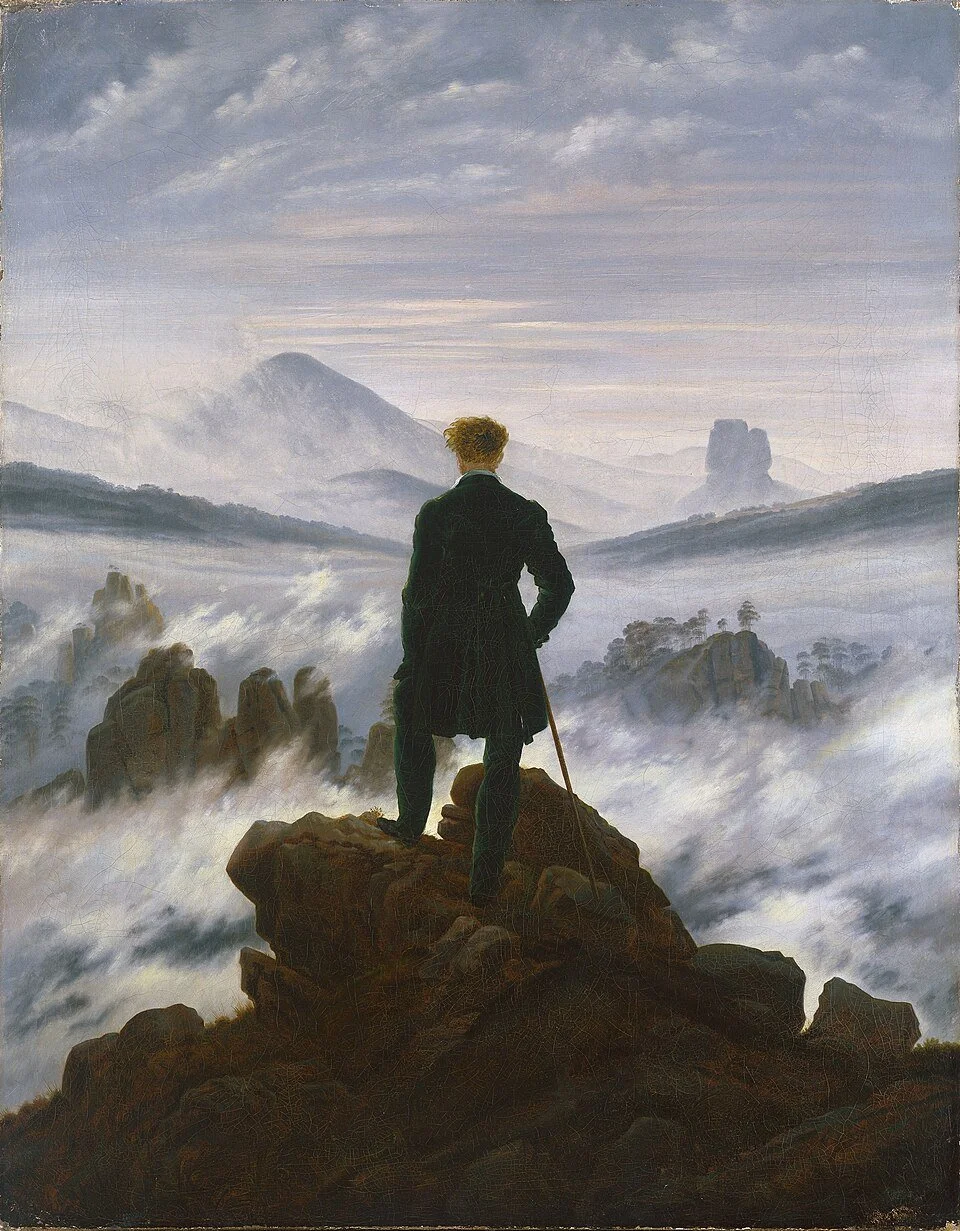

Caspar David Friedrich, Wanderer Above The Sea of Fog, 1818

When Finance Outpaces Civilization

The truth is: capital has gone post-geographic, post-human, and increasingly post-civilizational.

Wealth is no longer just:

Assets under management

Liquidity

Or even ownership

It is now algorithmic behavior, reputation signaling, and meta-sovereignty.

Financial markets move faster than the democracies that regulate them. Wealth portfolios shift faster than ecosystems can recover. Capital instruments are now more complex than the civilizations that host them.

This is not wealth creation. It is civilizational arbitrage.

Civilization Has a Balance Sheet Too

We talk about risk-adjusted return. But what about planet-adjusted value?

Here’s a simple economic question with enormous implications:

What is the ROI of a healthy biosphere?

The cost of ignoring it:

$178 trillion: Estimated GDP loss by 2070 from climate inaction (Deloitte Economics Institute)

$9 trillion: Global economic burden from biodiversity collapse (Swiss Re Institute)

$16 trillion: Projected cost of mental illness by 2030 (Lancet Commission)

Now imagine what happens when those three risks interact nonlinearly — something Stanford’s Complex Systems Group warns about in its 2025 Meta-Risk Report:

“The new normal is systemic non-linearity. Risks no longer compound — they cascade.”

In short: wealth that ignores reality becomes unreality.

Historical Warning: When Capital Decouples from Meaning

We’ve seen versions of this before:

Late Roman Empire: monetary debasement + elite retreat = civil decay

Dutch Golden Age: speculative excess + civic inequality = implosion

Tang Dynasty: bureaucratic brilliance + metaphysical drift = fragmentation

What they all had in common: They mistook financial innovation for civilizational strength.

We are now at risk of doing the same — only at planetary scale.

The Three Futures of Wealth

1. Accelerated Collapse

AI + capital = automated extraction at planetary scale

Collapse via complexity overload

Outcome: Wealth as ghost system

2. Neo-Feudal Drift

Power consolidates in capital-elite enclaves

Democracy and commons unravel

Outcome: Wealth as fortress logic

3. Living Wealth Systems

Wealth re-embedded in life-supporting feedback loops

Capital flows governed by ecological, relational, and ethical coherence

Outcome: Wealth as regenerative intelligence

Only one of these futures is investable across generations.

The Steward’s New KPI

If you steward capital — as a family office, fund principal, founder, or board member — the question is no longer how much wealth you manage.

The real question is:

Is your wealth metabolically, morally, and systemically compatible with the world that sustains it?

We believe it’s time to evolve how we measure value. Here’s how tomorrow’s stewards will think:

From ROI (Return on Investment) → To ROR (Return on Regeneration)

From Risk-Adjusted Return → To Systemic-Risk-Adjusted Return (including ecological, social, and temporal risk)

From Time Horizon: 5–30 years → To Multi-Species, Multi-Century Horizon

This isn’t idealism. It’s survival. It’s not philanthropy. It’s portfolio adaptation in a world of accelerating feedback loops.

This isn’t radical. It’s rational. It’s the minimum viable mindset shift required to operate in a multi-crisis century.

Wealth, Re-Membered

Let’s close with a deeper return.

“There are more derivatives than species.” One scales abstraction. The other sustains existence.

Wealth has always been about more than money:

In Ancient Greece: oikonomia meant household harmony.

In Lakota philosophy: wówačhaŋtognaka meant generosity as status.

In modern behavioral economics: well-being peaks at $75K/year — beyond which, emotional return flattens.

Maybe the next breakthrough isn’t in yield. It’s in meaning.

To protect your wealth, you must protect the world. To protect the world, you must evolve your theory of wealth.

This is not philanthropy. It is civilizational risk management.

What the Wealth?! Koan:

What the wealth awakens in capital — when capital remembers its place in the world?

By Ryna Mi, Wealth Systems Scientist | Creator of Sovereign Wealthfulness™ | Host of “What the Wealth?!” #SovereignWealthcare #FractalWealth #PostCapitalism #LivingSystemsEconomics

Want More?

Comment below: Which of the Three Wealth Futures are we most likely heading toward?

Share with someone managing wealth in a collapsing system.

Message me for briefings on Fractal Wealth Systems, Legacy Stewardship, or Civilizational Capital Strategy.

REFERENCES & SOURCE MATERIAL

Economic + Financial Data

Deloitte Economics Institute (2022) – "Global Turning Point: The Economic Impact of Climate Change". Link → Used for projected GDP loss due to climate inaction.

Swiss Re Institute (2021) – Biodiversity and Ecosystem Services Index. Link → Cited for global biodiversity collapse impacts on financial stability.

World Economic Forum Global Risks Report (2024) Link → Referenced for “Misinformation-Driven Societal Breakdown” as top long-term risk.

Credit Suisse Global Wealth Report (2023) → Cited for total global wealth surpassing $500 trillion.

World Bank & IMF Polycrisis Narratives (2023–2025) → General framing for the convergence of systemic global risks.

Historical Context & Civilizational Parallels

Thomas Cole – "The Course of Empire" series (1833–1836) Metropolitan Museum of Art Collection → Used metaphorically to depict civilizational rise, climax, and collapse.

Niall Ferguson – The Great Degeneration (2012) → Referenced for institutional decay and parallels to Rome and the Dutch Republic.

Joseph Tainter – The Collapse of Complex Societies (1988) → Systems collapse through diminishing returns on complexity.

Peter Turchin – Ages of Discord (2016) → Empirical modeling of socio-political fragmentation and elite overproduction.

Ecological + Civilizational Risk

Donella Meadows et al. – The Limits to Growth (1972, 30-year update) → Foundational work on feedback loops, overshoot, and system collapse.

Kate Raworth – Doughnut Economics (2017) → Framework for planetary boundaries and social foundations.

Jem Bendell – Deep Adaptation (2018) → On navigating potential societal breakdowns due to climate and systemic overshoot.

Rockström et al. – Planetary Boundaries Research (Stockholm Resilience Centre) Link

Philosophy & Ontology of Capital

Karl Polanyi – The Great Transformation (1944) → Cited for the concept of disembedded markets.

Aristotle – Politics & Nicomachean Ethics → Oikonomia (household management) vs. Chrematistics (wealth for its own sake).

Mark Fisher – Capitalist Realism (2009) → Referenced in “easier to imagine the end of the world than the end of capitalism.”

David Graeber – Debt: The First 5000 Years (2011) → On the moral roots of money and civilizational trust structures.

Branko Milanović – Capitalism, Alone (2019) → Discusses neo-feudalism and political inequality.

Nick Srnicek & Alex Williams – Inventing the Future (2015) → For accelerationist frameworks.

Kate Pickett & Richard Wilkinson – The Spirit Level (2009) → Inequality's corrosive effects on societal trust and cohesion.

Systems Theory & Complexity Economics

Donella Meadows – Thinking in Systems (2008) → Feedback loops, delays, leverage points.

Yaneer Bar-Yam – New England Complex Systems Institute (NECSI) → For cascading failure and systemic risk theory.

Elinor Ostrom – Governing the Commons (1990) → Successful stewardship models in polycentric governance.

Psychology, Ethics, and Wealth

Daniel Kahneman & Angus Deaton – High Income Improves Evaluation of Life But Not Emotional Well-Being (2010) → Reference for happiness plateau at ~$75,000/year.

Michael Sandel – What Money Can’t Buy: The Moral Limits of Markets (2012) → Used to explore value distortion in commodified systems.

Erich Fromm – To Have or To Be? (1976) → Philosophical framing of being-oriented vs. having-oriented societies.