#whatthewealth

A newsletter of unconventional insights on wealth, life, and legacy systems.

When Wealth Stops Circulating

Why do capable, well-resourced systems feel persistently tight — even when they appear successful?

This is a diagnostic essay about a shift from scarcity to misallocation, and what happens when wealth stops circulating and begins compensating instead. It is not a guide or a critique, but an attempt to name a structural condition increasingly visible across economies, organizations, and individual lives.

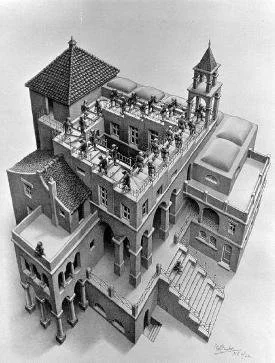

The Price of Permanence: How the Visible Became the Most Valuable

A painting hangs in silence and becomes an asset. A song drifts through air and leaves no balance-sheet trace. A dance, a poem, a performance — remembered, felt, transmitted, yet never capitalized.

We built an art market to hold on to what vanishes — to turn fleeting presence into permanent proof.

We call it “wealth” today only when it survives being measured.

Visual art didn’t become the apex of culture because it’s deeper. It became the apex because it’s better collateral.

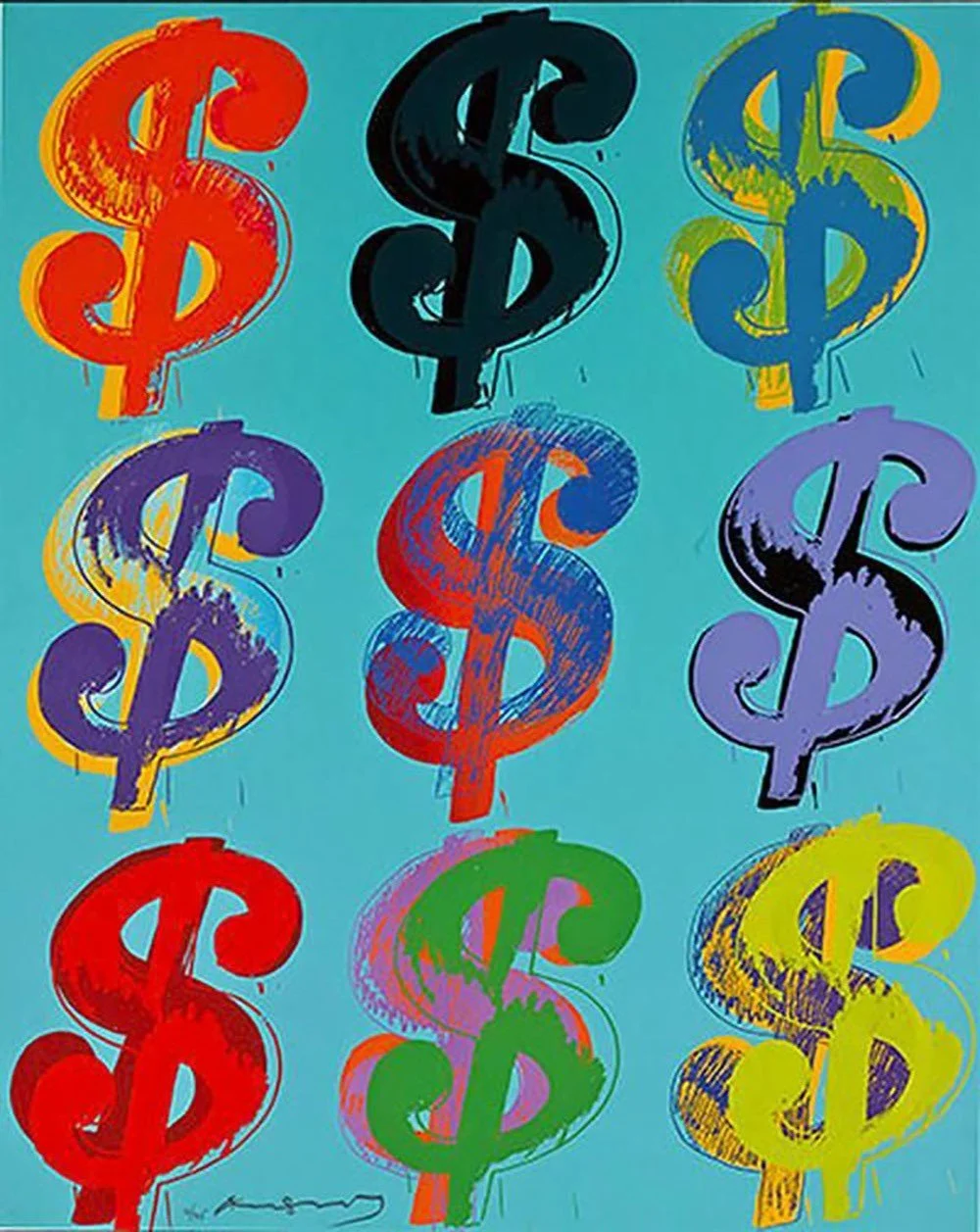

The Scandal of Singular Wealth

Wealth today is built on an illusion.

The illusion is that it is singular.

We measure digits while life itself breaks down.

The numbers go up, the humans break down.

If wealth is more than money, what belongs in our portfolio?

And what happens to the commons if we fail to ask?

The $5 Trillion Question They Forgot to Ask

I recently have been asking rooms of teenagers — heirs to extraordinary fortunes — a question that doesn’t appear on balance sheets:

“What is your wealth?”

No lead-in. No coaching. Just the question.

And here’s what happened: 99 out of 100 didn’t mention money.

Not even once.

✦ Their Answers Were Unmistakable

“Time with my sister before she leaves.” “A forest I can name.” “Not having to perform all the time.” “Being able to cry and not apologize.” “Knowing I can change my mind and still be loved.”

These weren’t curated. They weren’t metaphorical. They were unfiltered truths—offered before the world arrived to edit them.

What they described wasn’t financial. It was existential.

What Remains: Love, Dignity, and the Wealth We Can’t Tokenize

I once wrote an article called “Tokenization of a Smile.” Not as satire. Not as performance. But with just enough irony to name what I couldn’t yet say out loud:

We were living in a world that had already begun commodifying the human.

I was still wearing a white suit and closing complex deals—but part of me had already left the room. What I didn’t realize at the time was this: That article wasn’t a clever industry take. It was my soul trying to leak through the seams...

Wealth Without a World: When Capital Outruns Civilization

What happens when our wealth systems no longer need a world to function — but we do?

We’re Winning on Paper. And Losing the Plot.

In 2024:

Global wealth hit $500 trillion for the first time.

AI-driven fund strategies generated a 27% alpha over traditional portfolios.

The top 1% controlled more wealth than the entire global middle class

Meanwhile, in the same year:

42% of global topsoil became moderately to severely degraded.

The World Economic Forum ranked “Misinformation-Driven Societal Breakdown” as the #1 ten-year global risk.

Mental health disorders surpassed cardiovascular disease as the world’s leading health burden (WHO, 2024).

If you're managing capital today, ask yourself: Are your returns calibrated to a world that’s disappearing?

The 23,000 RISING GEN: A Forgotten Force in Wealth System Design

What if the greatest wealth revolution of our time won’t come from the masses… but from 23,000 heirs?

What if the future of wealth doesn’t belong to policymakers or billionaires — but to 23,000 conflicted, invisible, Rising Generation heirs… who didn’t design the system, but are now expected to govern it?

Rising, not “Next.”

Because they’re not waiting in the wings of history. They’re already here—living, leading, deciding—often silently, and often alone.

Who Rules? Wealth, Not Nations?

No speeches. No fireworks. No declarations. Yet, something irreversible has already shifted.

When billionaires can silence presidents, launch satellites, build cities, and redraw economies — what role is left for nations?

When personal wealth eclipses public budgets, who really sets the law of the land?

When influence no longer needs a flag, what happens to citizenship?

Maybe the coup we feared wasn’t a sudden storm. Maybe it was a slow leak — a quiet, relentless migration of power from ballots to balance sheets…

Beyond Capital: The Hidden Laws of Systemic Wealth Dynamics

Could it be that true, lasting wealth isn't something you merely accumulate through quick schemes or even long-term compounding, but something you actively shape, influence, and steward at a deeper, systemic level?

Learn, Earn, Return: What If Wealth Was Designed to Flow?

Could it be that the problem isn’t whether to give or invest—but rather, how financial capital moves, where it flows, and whether it is structured to create both immediate relief and systemic change?